8024976791 How to Profit From Small-Cap Stocks in 2025

Identifying profitable small-cap stocks in 2025 requires a strategic, data-driven approach that emphasizes early recognition of growth patterns and market signals. Investors must analyze financial metrics, leverage technical indicators, and adapt to evolving trends to optimize entry points. While diversification and risk management remain essential, the key lies in continuously monitoring market dynamics to capitalize on emerging opportunities before they mature, making the next steps crucial for sustained success.

Identifying High-Potential Small-Cap Stocks for 2025

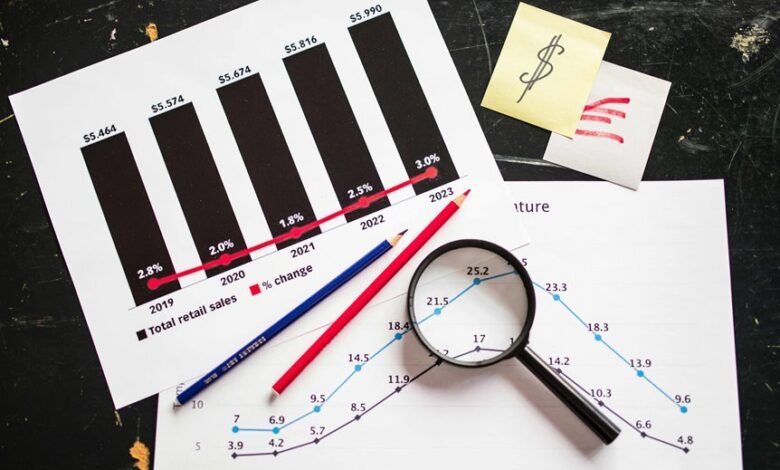

As the landscape of small-cap stocks evolves in 2025, investors increasingly rely on quantitative metrics and market trends to identify high-potential opportunities.

Market timing and technical analysis serve as essential tools, enabling strategic entry points.

Data-driven insights reveal emerging growth patterns, empowering investors to make autonomous decisions aligned with their pursuit of financial freedom.

Strategies to Mitigate Risks and Protect Your Investments

Effective risk mitigation is fundamental when investing in small-cap stocks, particularly given their inherent volatility and limited liquidity. Employing diversification strategies and risk management techniques reduces exposure to sector-specific downturns and unpredictable swings.

Strategic allocation and continuous monitoring safeguard capital, enabling investors to maintain freedom while navigating the small-cap market’s inherent uncertainties with disciplined, data-driven safeguards.

Techniques for Maximizing Growth and Profits in the Small-Cap Market

Maximizing growth and profits in the small-cap market requires a targeted approach rooted in rigorous analysis and strategic timing.

Investors should leverage market timing to capitalize on emerging trends and employ dividend strategies to generate steady income.

Strategic entry and exit points, combined with disciplined analysis, enable investors to optimize returns while maintaining the freedom to adapt swiftly.

Conclusion

In conclusion, navigating the small-cap landscape in 2025 demands a disciplined synthesis of data analytics, technical acumen, and risk management. By identifying emerging growth patterns early—akin to reading a market’s subtle pulse—investors can capitalize on lucrative opportunities before they eclipse. Yet, as markets are inherently unpredictable, prudence remains paramount; for in the symphony of investment, timing and diversification are the silent conductors guiding sustained success.